Equipment Appraisals for Donations of Manufacturing Machinery and Equipment

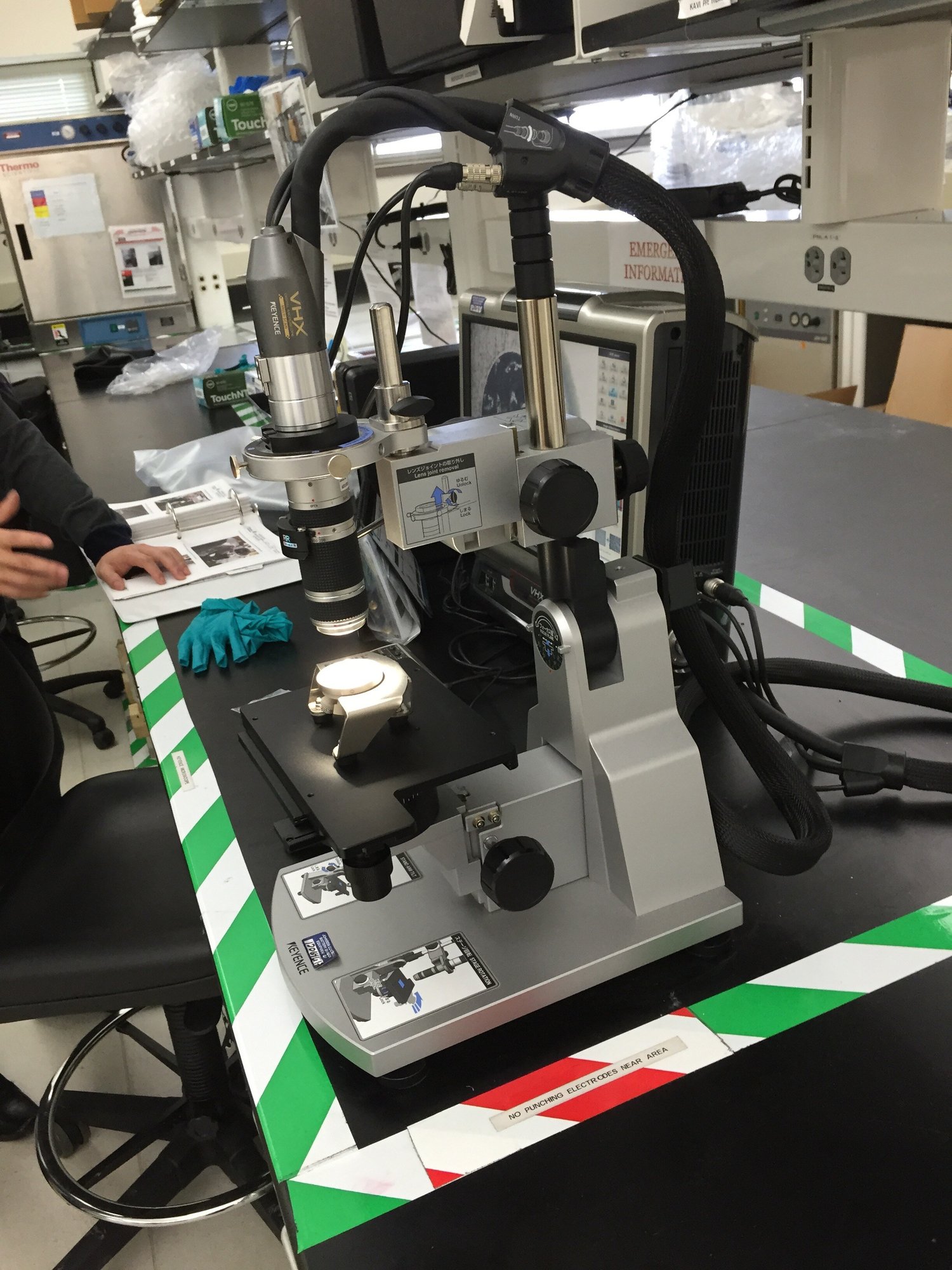

In need of an equipment appraisal or valuation of your manufacturing company’s machines? Our valuation specialists have decades of experience working with manufacturing companies and business owners assisting them with complex analyses related to valuation.

Equipment appraisals are important for donations because they determine the fair market value of the items being donated. This valuation is crucial for donors who wish to claim tax deductions, as tax authorities require accurate assessments to validate these claims. An appraisal provides official documentation that can protect both the donor and the recipient organization in case of audits or legal inquiries. If your tangible asset donation is worth over $5,000 then an appraisal is needed. Part IV on IRS Form 8283 is the Declaration of Appraiser section that requires a signature of a qualified appraiser.

Why us? Not all valuation firms are the same. Experience and credentials matter. We encourage you to review these 7 questions before selecting your valuation provider and then review our experience to see if we are the right fit for you and your situation.

We are specialists working with manufacturing companies nationwide.

To discuss your equipment appraisal needs for your manufacturing company for donations, review our service offerings and fill out the information request form or give us a call for a no-cost phone consultation.

Contact Us

To discuss your manufacturing valuation needs, review our service offerings and our FAQs, and then fill out the information request form for an initial no-cost consultation to see if there is a fit.